The prime rate averaged 3.96 percent over the past twelve months. Iowa law requires that this average be rounded to the nearest whole percent and two percentage points to be added to it. The annual rate is based on the average monthly prime rate during the preceding twelve month period, October through September.

STATE OF IOWA INCOME TAX BRACKETS 2021 CODE

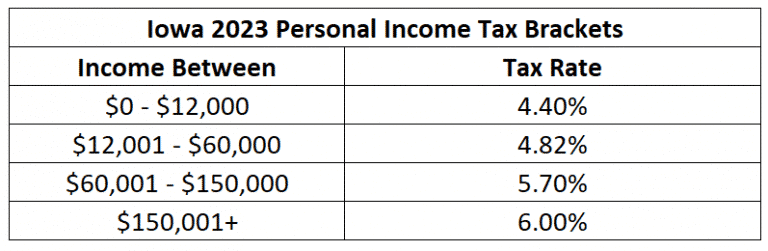

Iowa Code Section 421.7 specifies the procedures for calculating the Department’s annual and monthly interest rates. Starting January 1, 2023, the interest rate for taxpayers with overdue payments will be: “What we saw happen last week was rushing through a $1.7 billion tax bill so that could have something to talk about tonight on the national stage,” Konfrst said.Īsked about the timing of the tax cut deal, Republican Statehouse leaders have pointed to the fact that they started working on tax policy much earlier in the session than they usually do and that tax cuts were their top priority for the year.Des Moines, Iowa – The Iowa Department of Revenue announces individual income tax brackets and individual income tax standard deduction amounts for the 2023 tax year (applicable for taxes due in 2024) and the 2023 interest rate, which the agency charges for overdue payments. She also criticized the timing of the bill becoming law as Republicans reached a deal and sent the bill to Reynolds' desk last Thursday. House Minority Leader Jennifer Konfrst, D-Windsor Heights, said Reynolds should thank President Joe Biden for sending more pandemic relief funds to the state that helped make the tax cuts possible. “She’s been governing for those at the very, very top.”ĭemocrats proposed expanding the Earned Income Tax Credit and the Child and Dependent Care Tax Credit, but the GOP majority rejected those ideas.

“We certainly feel like Governor Reynolds has not been governing for all Iowans,” Wahls said. Senate Minority Leader Zach Wahls, D-Coralville, criticized the tax cuts for giving the biggest benefits to the wealthiest Iowans. Many states are cutting taxes this year as federal pandemic relief programs and unexpected rates of economic growth are boosting state revenues and leaving large budget surpluses.

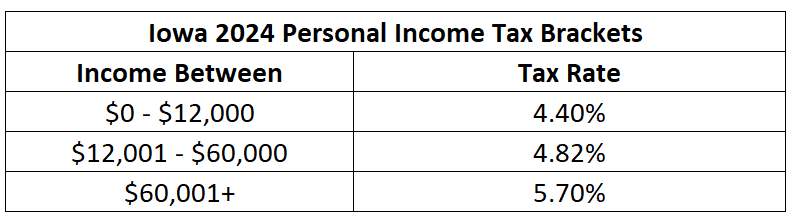

“And this bill will ensure that Iowa will compete for those jobs and those workers.” “In this post-pandemic economy, competition is fierce for jobs and workers,” Whitver said. He said Republicans are delivering on their promise to return tax dollars to Iowans when there is a budget surplus. Senate Majority Leader Jack Whitver, R-Ankeny, said it’s an historic day. Reynolds signed the law at a local manufacturing facility surrounded by a crowd of Republican lawmakers. The corporate tax rate will also be reduced over time, along with reductions in some corporate tax credits. It will eliminate state taxes on retirement income starting next year, and enact new tax breaks for retired farmers and people retiring from employee-owned companies. The new law will phase in a flat 3.9 percent personal income tax by 2026, while preserving existing tax credits. “Today is a great day for the state of Iowa as we dramatically reform Iowa’s tax system for the better and make our state one of the most competitive in the nation,” Reynolds said.

Kim Reynolds signed a major tax cut package into law Tuesday, completing her top priority for the legislative session just hours before she was scheduled to deliver the Republican response to the State of the Union address.

0 kommentar(er)

0 kommentar(er)